Brian Gale Holdings has made a firm commitment to being a responsible investor and to actively consider clients’ sustainability objectives.

Brian Gale Holdings Limited is a primier holding company based in Redhill England, with a diverse portfolio spanning various sectors, we specialize in providing exceptional investment opportunities to both local and foreign clients. Our strategic focus areas includ green energy, stock, innovation, solar energy, company shares, real estate investment, healthcare and finance. We are committed to driving sustainable growth, fostering innovation, and delivering substaintial returns for our valued investors.

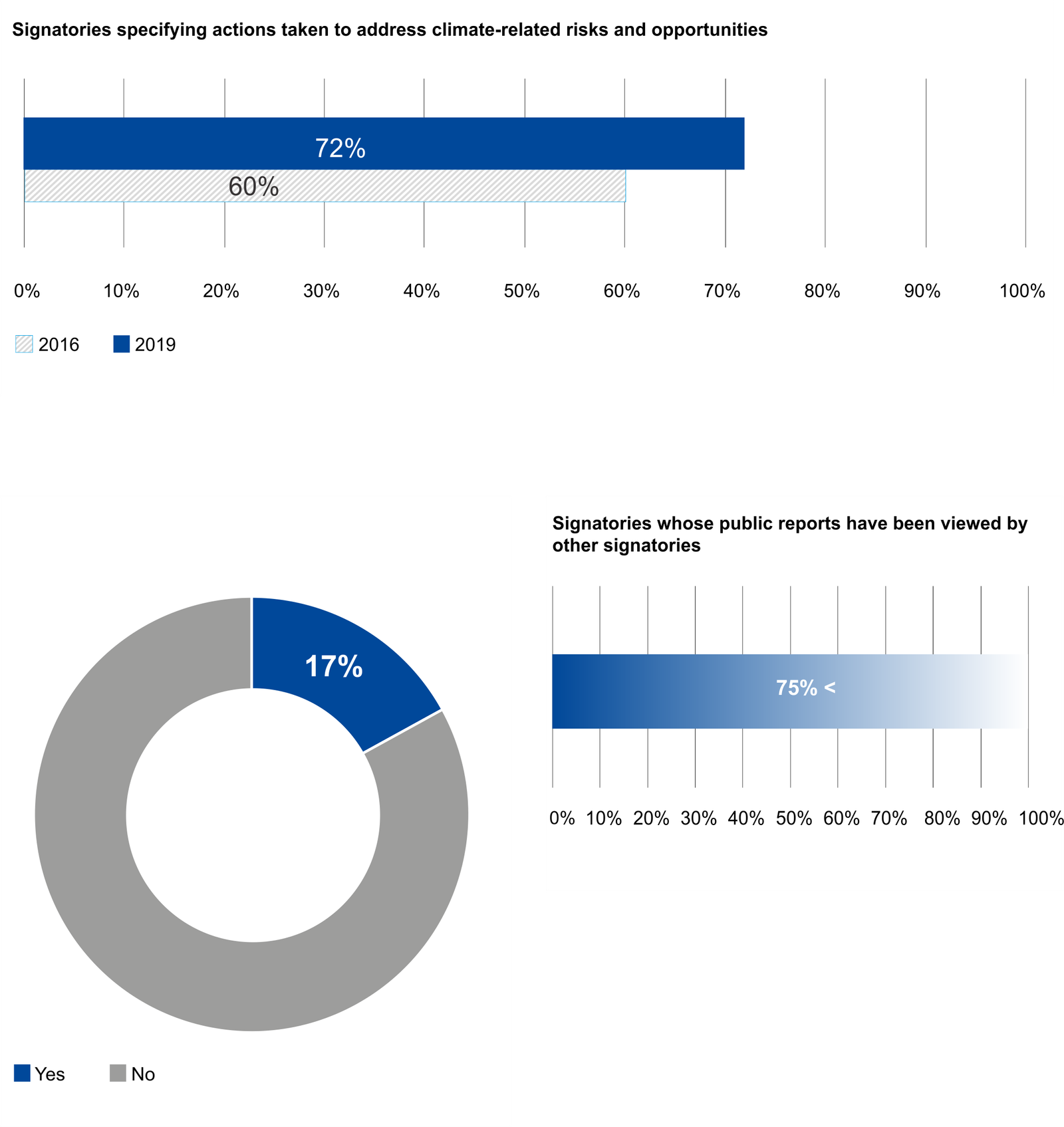

We are aware of the challenges facing the natural environment and believe that financial markets have an important role to

play in creating a more sustainable world.

We believe that the allocation of capital can affect society and the environment, and we aim to play a positive role in this change.

We are conscious that we do not operate in isolation and that the way we invest or manage our assets might impact, positively or negatively,

environmental and social sustainability objectives. If we invest in a responsible manner, our partners,

colleagues and clients can all be proud of their association with Cavalry Finance. This is a strong motivation.

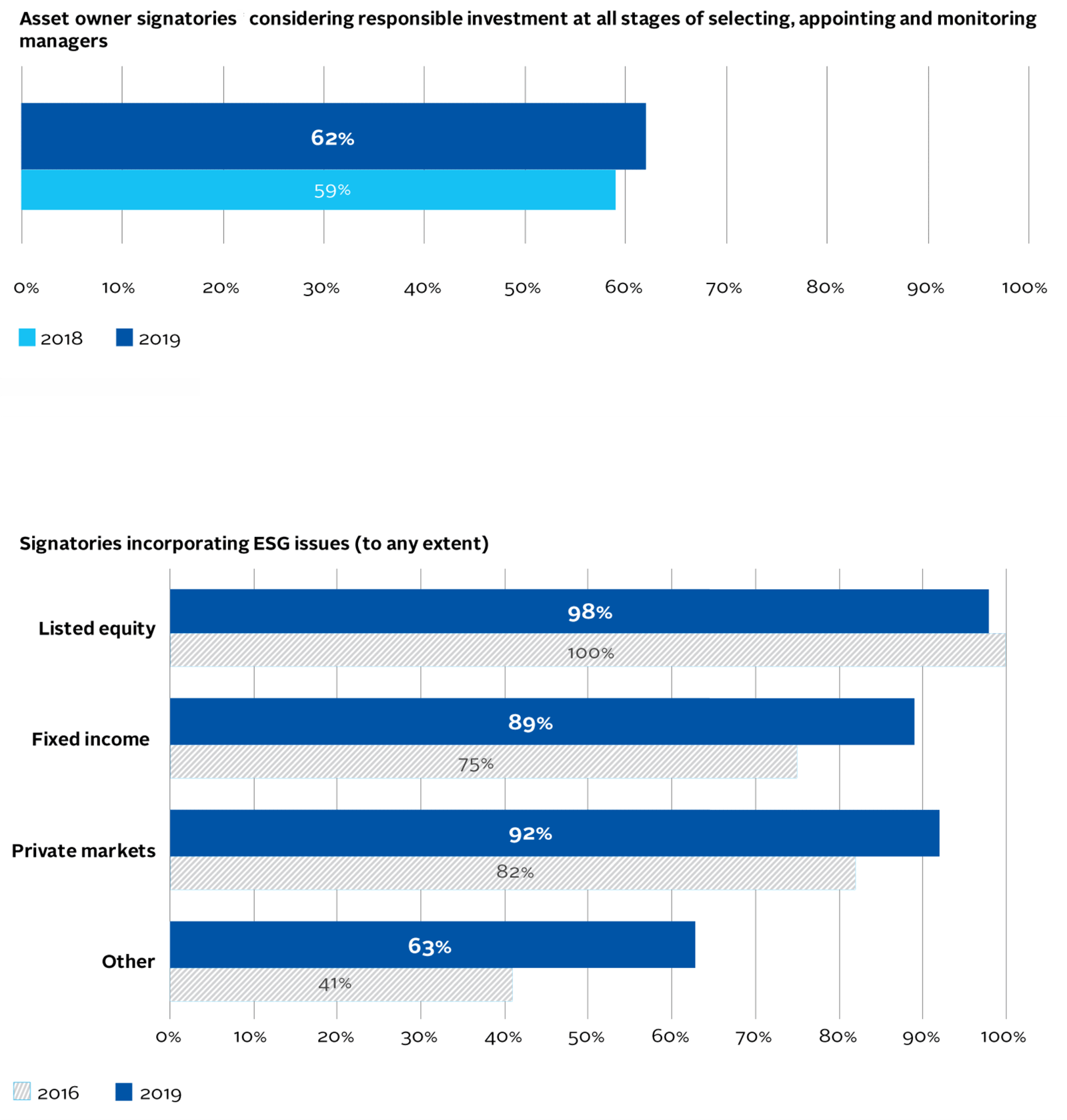

As a firm, we aim to act as responsible investors. For us, this means enabling our investment professionals to: consider and integrate ESG risks and sustainability issues in their investment decision-making; acting as good stewards of capital in the way we exercise our voting rights; engage with companies and the wider industry; and communicate and interact with our clients on these issues.

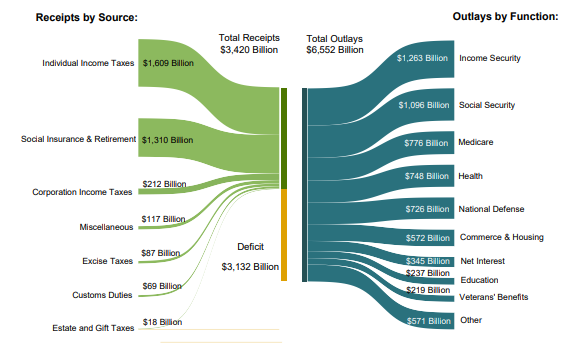

Our growth in becoming one of the largest alternative investment managers is aligned with this vision and is a testament to our shared values, experienced management team, and focus on performance and high-quality investor base, which includes large pension funds, insurance companies, banks and private banks, sovereign wealth funds and university endowments.

As trusted stewards, our mission is to invest to help businesses flourish and create enduring value for all of our stakeholders. We provide flexible capital to established businesses in the credit, private equity, real estate and secondary markets.

The Brian Gale Holdings Advantage is that these distinct but complementary investment groups, with approximately $5 billion of assets under management, collaborate to leverage the power of the firm’s platform to aim to deliver innovative solutions and attractive risk-adjusted returns. We believe the synergies from this multi-asset strategy provide our professionals with insights into industry trends, access to significant deal flow and the ability to assess relative value.

Whether it’s protecting and growing the capital of our Limited Partners, creating long-term value for our shareholders or aligning our interests with business partners, our team focuses on driving shared success.

Since our inception in 2016, we have adhered to a disciplined investment philosophy that focuses on delivering compelling risk-adjusted investment returns throughout market cycles.

We strive to maintain a consistent credit-based approach that targets well-structured investments in high quality businesses and real estate assets.

Our asset managers come from a diverse range of backgrounds but share a passion for solving problems and building businesses. We use a balance of experience and foresight to help businesses focus on what’s important. Using our System 7 Asset Management Framework, our teams work with portfolio company management teams to drive improvements – across operations, financials and ESG.

Understanding and engaging with stakeholders: Identifying key stakeholder relationships and create positive two-way dialogue for mutually beneficial outcomes.

Setting strategic vision: Challenging management to define an ambitious and sustainable strategy for the portfolio company aligned with stakeholder and shareholder expectations.

Putting the right leadership in place: Actively assessing management to get the best leadership for each portfolio company, and to ensure succession planning is in place.

Focusing operations: Detailed planning to align management goals with shareholder and stakeholder value.

Optimising capital: Optimal capital structures and funding arrangements taking account of individual risks, regulation and capital expenditure needs of each portfolio company.

Managing risk: Risk assessment and management is central to MIRA’s approach to asset management and is applied across the investment lifecycle.

Clear governance: Clearly defining corporate governance structures and practices to ensure management have operational responsibility and accountability.

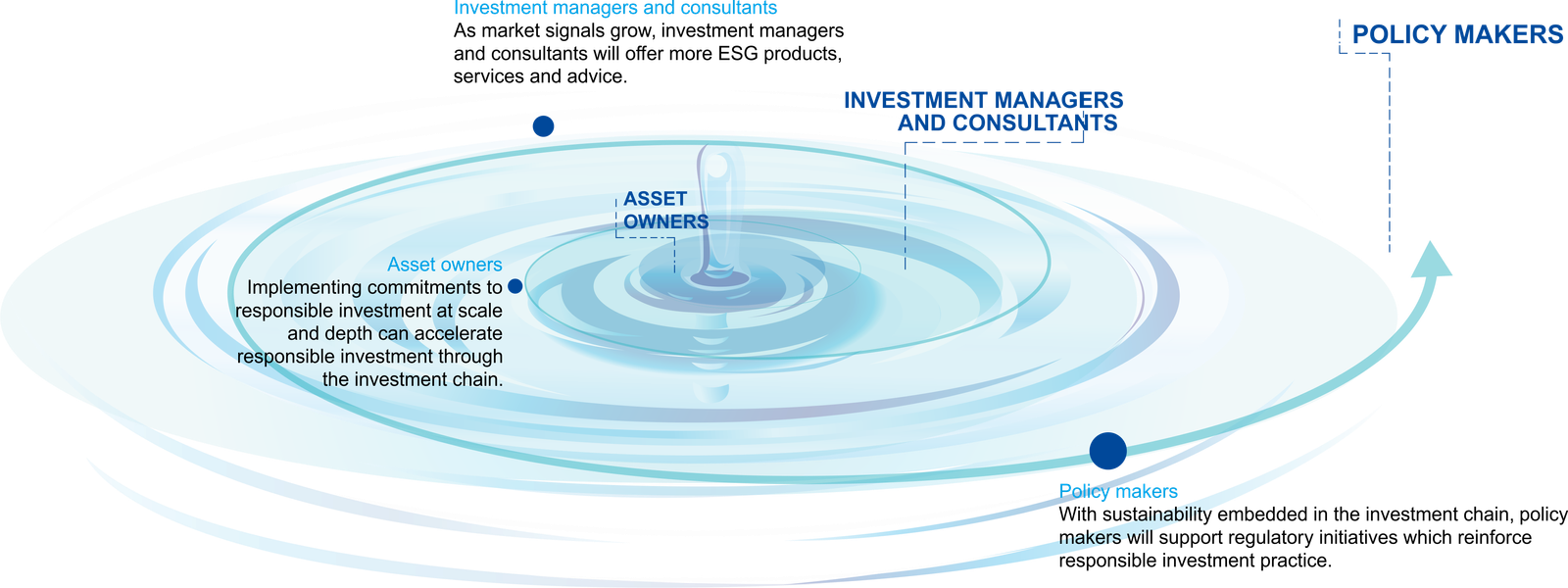

Asset owners set the direction of markets: the mandates they award to managers determine the objectives that the world’s biggest pools of money are put to. To fulfil their duties to beneficiaries in the 2020s and beyond, asset owners will need robust approaches to investment that acknowledge the effects their investments have on the real economy and the societies in which their beneficiaries live.

For investors to fully pursue responsible investing, they need the global financial system that they operate in to be sustainable. The global financial crisis of 2007–2008 gave dramatic and incontrovertible evidence that investors need to play their role in ensuring the stability and sustainability of the financial system on which they rely. Excessive leverage, dealing in complex derivatives and high-frequency trading may benefit some in the short term, but they undermine the resilience of the system as a whole.

The financial system should enable individuals, organisations and governments to reliably store their assets for future use, and should support sustainable economic development by making those assets available for responsible, productive use by others in the meantime. We will work on the parts of the system where we can make a difference – beneficiaries; investors; their advisors and service providers; companies and issuers; securities exchanges; regulators – and will monitor environmental, social, technological, economic and political trends that will continue to reshape the financial system as we work.

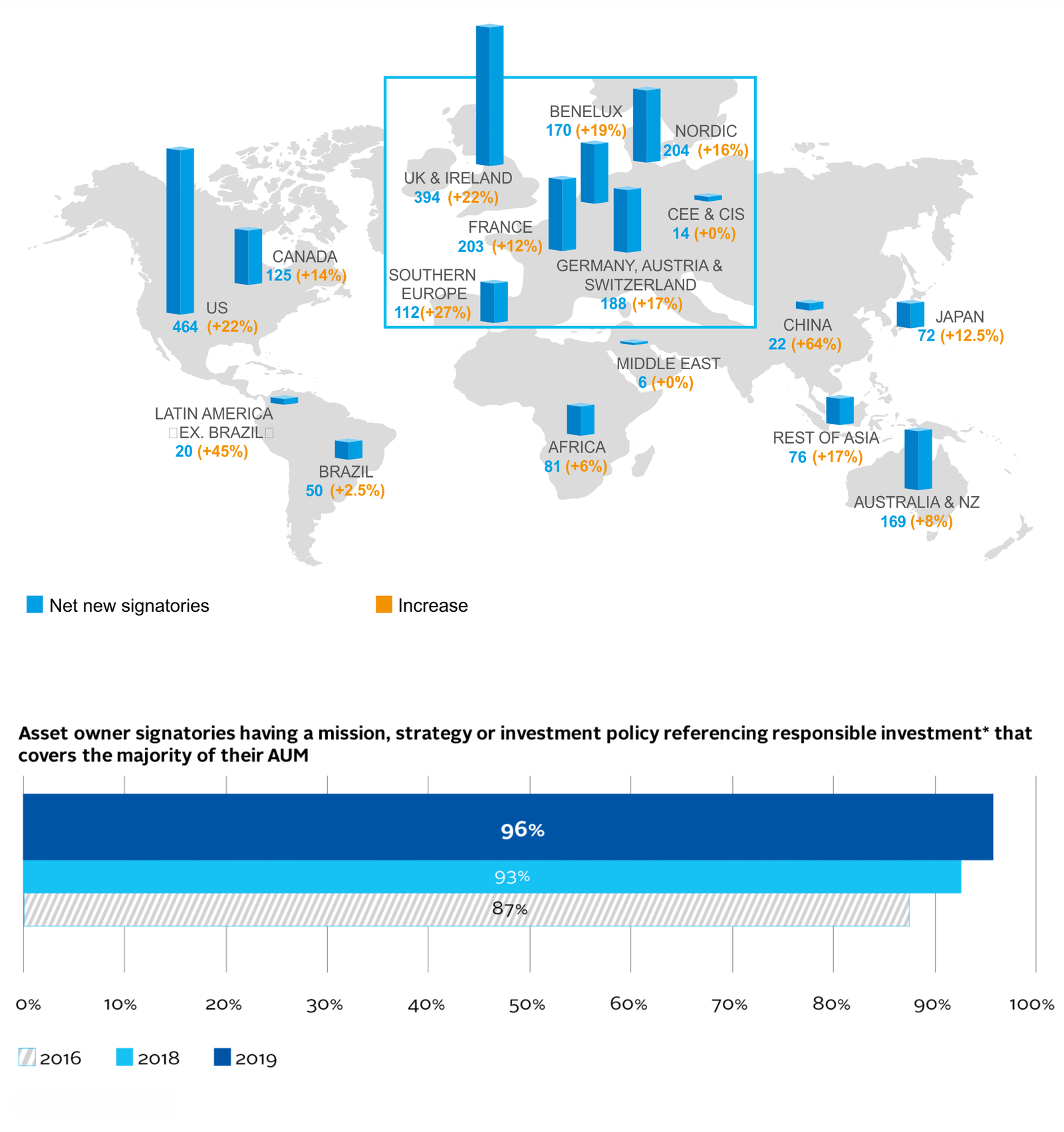

The 2017/18 signatory growth rate was, at 22%, the highest

since the 2010/11.

We recruited 69 asset owners in 2018/19, of which 27 were

strategic targets, with growth particularly strong in the UK

(12 new asset owners), the US (11), the Netherlands (eight)

and across Southern Europe (eight). Beyond the traditional

public pension funds, new areas of asset owner growth

include increasing numbers of corporate pension funds,

insurance providers, public treasuries and central banks

Among the new joiners were LGPS Central and National Grid PS in the UK, AG2R (France), Novartis PF (Switzerland), PenSam (Denmark), City of Chicago and Illinois State Treasury in the US, AFP Cuprum (Chile), AFP Prima (Peru), GPF Thailand, AIA (Hong Kong), and Meiji Yasuda (Japan).